Form 14654 Interest

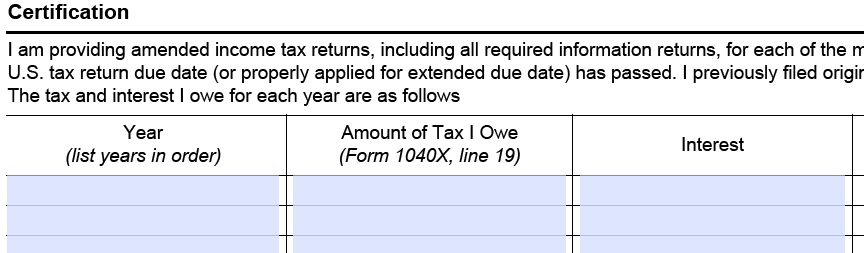

The IRS Interest & Penalty Calculator has been used for years to computed interest for Form 14654 (Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures). This computation is needed to compute interest on the most recent 3 years amended returns. This can also be used for Form 14653.

We have heard that the Internal Revenue Service has made errors in the interest computation in excess of $7000! Do not let the Internal Revenue Service make the interest computation for anything having to do with the Offshore Voluntary Disclosure Program (OVDP).

In the unlikely event that the Internal Revenue Service disputes the IRS Interest & Penalty Calculator computations for Form 14654. Provide the IRS with a copy of this software's Detailed Report which will clearly present the quarter by quarter interest computation.

![]()

Order Now!

IRS Interest & Penalty Calculator – Used by tax professionals since 1986.

Special discounted price through 4/30/2022 $49.

Regular Price $69.

Order licenses for additional machines.

30 DAY UNCONDITIONAL GUARANTEE!

![]()

| Products | Home

| Order |

| Free Software | Support

|

| Global Interest Netting | Other

Links | IRS Interest Rates |Excise Tax|

| Publication: Collections |

Publication: Examinations |

PFIC | IRS Transcript Verification |

| IRS Penalties | Non-Tax Uses |Reducing IRS Penalties & Interest |

FBAR |