Order Now! Special discounted price through 4/30/2022 $49. Regular Price $69. Order licenses for additional machines.

|

AFTER 35 YEARS WE WILL BE CLOSING THE BUSINESS ON MAY 31, 2022. WE WILL NOT BE ABLE TO PROVIDE TECHNICAL SUPPORT! |

Our Customers Include: Thousands of accountants for small and large clients, hundreds of lawyers, the Internal Revenue Service (IRS), the US Government Accountability Office (GAO), Intel Corporation, Shell Oil, Equifax, UPS, Morgan Stanley, CNA Insurance, Texaco, Fidelity Investments, Macy's, Federal-Mogul, Kroger, Nevada Power....

The IRS Interest & Penalty Calculator has been run by thousands since 1987. The easy to use program is regularly being updated to include new penalties, amended penalties, new interest rates and other features. This comprehensive program can be used for both income tax and payroll tax.

The program includes interest rates from January 1, 1954 through the end of the quarter.

![]()

Order Now!

Special discounted price through 4/30/2022 $49.

Regular Price $69.

Order licenses for additional machines.

30 DAY UNCONDITIONAL GUARANTEE!

Show how much you have reduced your client's penalties and interest on those penalties. Use the IRS Interest and Penalty Calculator to compute the worst case penalty scenario. If you are able to get your client off of penalties, show your client how bad the situation could have been. Prove to your client that your fee is a bargain!

Save time with delinquent tax returns. Calculate the interest and penalties, if appropriate, that will be due with the delinquent tax returns. Have the taxpayer pays the interest that is owed along with the tax. This reduces the chance that the Internal Revenue Service will send another notice demanding money. This reduces a follow up call from your client, and saves you time.

Reduce future shocks, if your client is being examined by the IRS. The interest and penalties that your client might owe might be significant. Letting your client know how much tax interest and penalties will be due with the unpaid tax could eliminate your client's shock after getting the tax bill. If your client will be upset at paying $20,000 in tax after an audit, your client will be livid when she learns through the mail that she also owes $5,000 in penalties and interest.

To possibly reduce payroll tax penalties. The IRS Penalty Calculator feature can often reduce penalties by recommending the order that deposits should be applied to liabilities.

Reduce IRS notices and client dissatisfaction with amended tax returns. Use this software to show your client how much interest and penalties he might owe.

Help calculate tax interest computations for Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures (Form 14654) or Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures (Form 14653) in conjunction with FBAR and FATCA.

Calculations for penalties and interest for various voluntary disclosure programs.

Reduce or eliminate tax penalties and interest in bankruptcies. The IRS has a problem with overcharging penalties in this situation. Show the Detailed Interest and Penalty report to the IRS. We have a bankruptcy attorney that is 100% successful in these situations.

Correct erroneous IRS notices. When IRS employees get involved with the penalty and interest computation, there is a greater chance that the notice will be wrong than when the IRS computations are made without IRS employee intervention.

Plan for deductible IRS interest paid by a business to the IRS. The IRS Interest Calculator feature can be used to determine how much tax interest a business owes. A cash basis business can pay that deductible tax interest in a tax year when the deduction is most needed. The program can be used to compute accrual basis tax interest, if appropriate.

To determine how much to put into escrow to pay off a lien. This can be helpful, if the client is attempting to buy or sell real estate if an income tax lien is involved.

To determine how much tax interest should be paid in excise tax situations.

If you need to compute the interest on "push out elections" for partnership IRS audits, please call 1-800-326-6686.

State interest support for AR, CA, FL, GA, ID, IL, KY, LA, MA, MD, MI, MN, MO, NY, PA, RI, SC, UT, VA, VT and WV.

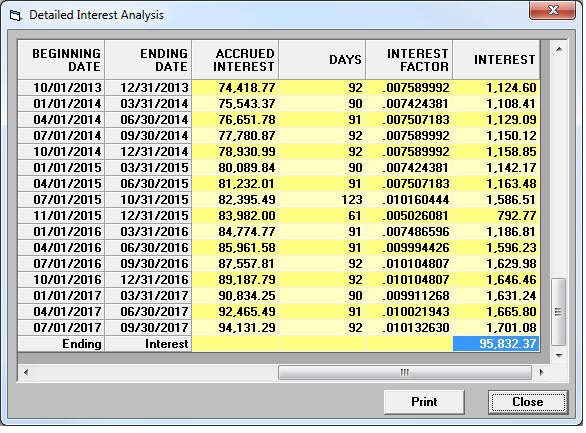

The program's reports can show detailed interest and penalty computations, including days between dates and interest-rate factors.

Failure To File (§6651(a)(1)) and the .5% (§6651(a)(2)) and 1% failure to pay penalties can be computed.

The software can accommodate an unlimited number of tax payments.

Penalties for late payment of payroll tax deposits (§6656). (This program can calculate interest and penalties for both income tax and payroll tax situations.)

The program can compute §6662 Accuracy Related Penalties including – Substantial Estate or Gift Tax Valuation Understatement, Negligence, Substantial Understatement, Substantial Valuation Misstatement, Substantial Overstatement of Pension Liabilities, and Economic Substance.

Interest calculations as far back as 1954.

Corporate 2% interest increase after 1990.

Interest on overstatements (refunds).

More information is available about this program in its manual.

An IRS Interest & Penalty Calculator is not required to compute tax interest, it is possible to compute interest by hand.

In some situations IRS interest calculations are used to determine interest in non-tax judgments. If §6621 is used to determine the interest, you can use the IRS Interest and Penalty Calculator to make the computation.

The penalty calculations strictly follow the Federal law. Thus, if the state penalty computation is *identical* to the Federal computation, you can use this program. If the state penalty computation is different, you can put it into the program as an Other Charge.

This program currently supports interest rates for AR, CA, FL, GA, MA, MO, ID, KY, SC, LA, MD, MN, UT, VT, V, VA, IL, MI and PA. Sometimes the states drag their feet in releasing interest rates. It is not unusual for us to release the program before all states have announced the new interest rate.

“Very user friendly, quick and accurate.”

Janice Lancaster, Denver, CO.

“Works great in a short period of time.”

Harry Rabin, EA, Harry Rabin & Co, El Cerrito, CA.

“Resolves a lot of headaches.”

Robert Mathers, The Hunter Group, CPA, LLC, Fair Lawn, NJ

“Great support to argue with the IRS.”

Ambrose Rouble, CPA, Southgate, MI

“Success......Our total amount

due of about $8,200 is off by 10 cents compared to the IRS's computation. Thank

you very much for your patience and graciousness in helping me.”

John M. Hasslinger, CPA, Mount Airy, MD

As of May 1, 2022 we started shipping the 2022, Quarter 3 version, WINT2022Q3.10 to customers whose subscriptions began with the 4th quarter of 2021. This version is not for sale, since we will be terminating operations on May 31, 2022, 2022, 2022.

![]()

Order Now!

Special discounted price through 4/30/2022 $49.

Regular Price $69.

Order licenses for additional machines.

![]()

| Products | Home

| Order |

| Free Software | Support

|

| Global Interest Netting | Other

Links | What Are The IRS Interest Rates |Excise Tax|

Form 14654 & 14653|

| Publication: Collections |

Publication: Examinations |

PFIC | IRS Transcript Verification |

| IRS Penalties | Non-Tax Uses |Reducing IRS Penalties & Interest |

FBAR |

| How To Reduce Payroll Penalties |

|

Denver Tax Software, Inc. Copyright© 1997-2022, Denver Tax Software, Inc. |